Labor Day Weekend Reading:

On this Labor Day weekend, I read two articles that prompted me to think about employee longevity and how much of a competitive advantage it may be. Interestingly, both were articles about Berkshire Hathaway companies, See’s Candies in Fortune and the Nebraska Furniture Mart in the Mart’s employee newsletter, “Heart of the Mart”.

Generally, I want to believe that employee longevity is a good thing and a competitive advantage. At the same time, I think it is probably only a competitive advantage as long as the company is growing, providing opportunities for its best people, and maintaining a dynamic culture. I would be worried about a company whose culture was lethargic and also had too much employee longevity because it would not be a good signal about the quality of the employees.

The Nebraska Furniture Mart ran a story in the August issue of “Heart of the Mart” employee newsletter about Jack Diamond, a 90-year-old furniture salesman who had been with the company for 58 years when he retired in July. Jack is pictured here. The Mart had 27 people achieve an anniversary of 20 years or more only in August this year. Fortune wrote about several employees at See’s Candies who had been at the company for 41 years (Beatriz Romero wrapping Scotch kisses), 32 years or 24 years. Among the companies where I am an owner, I looked at the National Holistic Institute that has a total of 114 employees and 2 have been employed over 20 years, 1 over 15 years, 13 over 10 years, and another 31 employees have been employed over 5 years. At NHI, that means about 13% of the employees have been there more than 10 years and over 40% have been there more than 5 years — I am not sure if this is above the norm or not for NHI’s industry but I suspect that it may be. One observation from NHI is that the long-term employees tend to be in roles that are very important for maintaining company culture (new hire training) and maintaining institutional knowledge (i.e., regulatory compliance, curriculum development).

The Mart had 27 people achieve an anniversary of 20 years or more only in August this year. Fortune wrote about several employees at See’s Candies who had been at the company for 41 years (Beatriz Romero wrapping Scotch kisses), 32 years or 24 years. Among the companies where I am an owner, I looked at the National Holistic Institute that has a total of 114 employees and 2 have been employed over 20 years, 1 over 15 years, 13 over 10 years, and another 31 employees have been employed over 5 years. At NHI, that means about 13% of the employees have been there more than 10 years and over 40% have been there more than 5 years — I am not sure if this is above the norm or not for NHI’s industry but I suspect that it may be. One observation from NHI is that the long-term employees tend to be in roles that are very important for maintaining company culture (new hire training) and maintaining institutional knowledge (i.e., regulatory compliance, curriculum development).

The Pros of Employee Longevity:

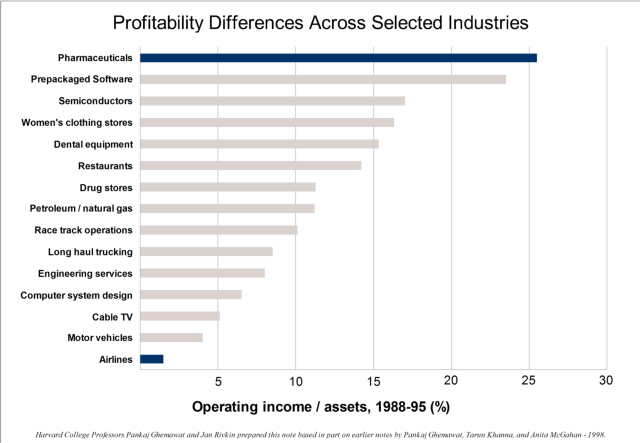

How much of a competitive advantage is employee longevity? The pros definitely outweigh the cons. It also struck me that employee longevity is probably a signal of a strong company that has established some competitive advantages. Here are some ways that employee longevity suggests a company is probably doing well:

- On the more obvious side of things, employee longevity suggests they have a lot of experience and therefore probably very efficient and effective.

- Longevity also says to me that the company is growing and improving over time. Otherwise, good employees will get bored and leave. A growing company keeps things interesting for good employees by providing them new challenges and professional growth opportunities.

- Longevity also suggests to me that the company continues to figure out how to provide value to its customers and is able to raise prices or improve margins or both. A company cannot keep employees over the long-term without steady compensation increases and therefore the company needs to be creating and capturing value to be able to keep those employees happy.

- Stability has probably been the norm. A company that has had a lot of turmoil will likely have employee turmoil making it more difficult for good employees to stick around.

- The company has probably found a rhythm of work that is balanced and healthy. Employee longevity probably suggests that the workload (normal and the heavy bursts necessary in any business) is sustainable by the employees over the long term.

- Employee longevity may suggest more of a team culture rather than a “star” culture. Star cultures often tolerate star performers that can be difficult to work with and may make a company more difficult for everyone else. The stars are also not likely to stick around very long and be off to the next place that makes them feel like more of a star.

- Company culture is probably strong and healthy at companies that have employee longevity because I would bail-out quickly if the culture of a company was poor.

I could not think of many ways that employee longevity would hurt a company’s competitive advantage, but I wanted to force myself to think it through. In some of these ideas, the businesses didn’t seem fun or interesting to me (but professional sports teams often have some of these characteristics) and they seemed liked industries or companies that are more likely to have management-labor strife. I suppose, is probably because the dynamics of the industry are more about capturing a larger slice of the pie rather than trying to work together to make the pie larger (a competitive distributive approach vs. a cooperative integrative approach to business).

- If the company needs employee wages to be low in order to survive, the company may want a constant influx of entry-level employees so that the higher paid employees move on after a few years.

- Some companies may need a constant source of fresh thinking.

- Some types of work may be difficult to do for a long period, maybe physically demanding work. I suppose professional sports teams may fall into this.

For me, I think it is more rewarding to be involved with companies where employee longevity is a win-win for the company and the employee — and that also means that the company is growing, creating value, and sharing that value creation with employees so that the relationship works over the long-term.

Categories:Competitive Advantage & Differentiation, Culture Is Strategic, Warren Buffett & Berkshire HathawayTags:Berkshire Hathaway, Competitive Advantage, Culture, Employee Longevity, Employees, HR, Human Resources, Nebraska Furniture Mart, See’s Candies, Teamwork, Warren Buffett

I am an investor at Greybull Stewardship, an

I am an investor at Greybull Stewardship, an

Sign Up

Sign Up RSS Feed

RSS Feed