Few organizations are as effective at establishing a culture as the Harvard Business School — and it is very deliberate, intentional, and no accident. I am back at Harvard Business School today and being here reminds me of the strategy and hard work the school performs to set a certain tone. And, the company culture of Harvard Business School will probably surprise most people because it is opposite of what you may expect.

Here are some things that the school very intentionally focuses on establishing in the culture of each class, each section, and at the school in general.

No Sharks. Disagreement and debate is the objective of the case method and classroom discussion, but it needs to be done respectfully and professionally to be effective. To signal to someone that they were too aggressive or confrontational in their comments, most all HBS classes have a shark stuffed animal that fellow students toss at someone who crosses the line. It is a friendly, fun way to give feedback to the aggressive types and help them keep things productive.

No Sharks. Disagreement and debate is the objective of the case method and classroom discussion, but it needs to be done respectfully and professionally to be effective. To signal to someone that they were too aggressive or confrontational in their comments, most all HBS classes have a shark stuffed animal that fellow students toss at someone who crosses the line. It is a friendly, fun way to give feedback to the aggressive types and help them keep things productive.- Everyone needs to participate — it is not cool for certain people to dominate. In life and business, we need input from everyone to make the best decisions. There is a deliberate strategy at HBS to encourage participation from everyone (your grade depends upon it) and to encourage the students to listen and glean wisdom from everyone.

- Idea diversity leads to insight and learning. There is value placed on a diversity of comments and observations and an active attempt to get different ideas into the discussion. I was always delighted with the diversity of comments and thoughts. Having such diverse good ideas makes you a little more humble that there are plenty of good ideas in addition to your ideas.

- Helping others is key. HBS indoctrinates you that everyone has an obligation to share ideas and offer explanation or assistance to your fellow classmates. It is a recognition that no one gets anywhere alone. And, teaching someone something is the best way to make sure you learn it yourself. Our comments were graded on how helpful they were in assisting others in their learning.

- Open discussion of “norms”. The school had us actively discuss the “norms” that we wanted our classes to have — how we wanted to be treated, how we wanted to treat others, etc. It made us actively think about the culture of the school and help get us all aligned like in a company culture.

While I do not remember the details now, I remember being amazed at the activities, hints, discussions, speeches, etc. organized by the school that were aimed at indoctrinating us into the culture of the school. It was not an accident. The culture was deliberately designed to establish the optimal environment for learning and for teaching the all-important soft skills of behavior that are important for success in school and after school.

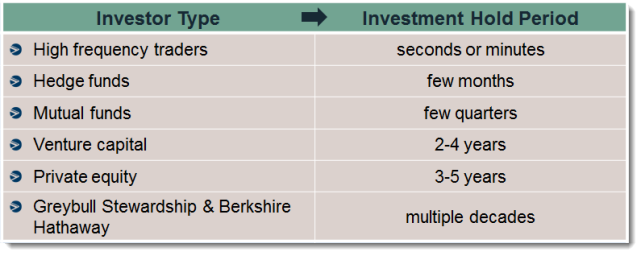

I am an investor at Greybull Stewardship, an

I am an investor at Greybull Stewardship, an

Sign Up

Sign Up RSS Feed

RSS Feed