Financing growth for your business with cash from customers, rather than more expensive debt or equity, makes your ownership even more powerful. In most of the investments made into operating companies by Greybull Stewardship, my investment fund, our operating companies get paid by customers before having to pay for the expenses of their products or services. This is called “negative working capital” and it’s the next post in my series on a “Perfect Business, Financially Speaking“.

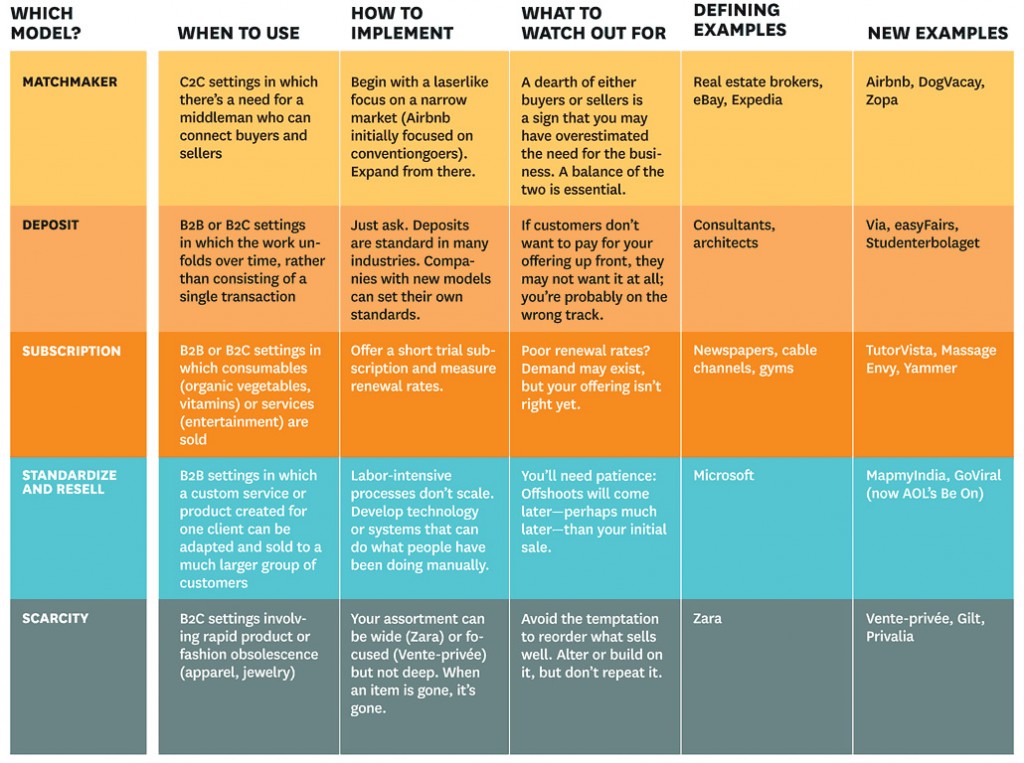

Chart on using customer cash by John Mullins of the London Business School as published in the Harvard Business Review.

Most businesses need working capital to operate. It is the capital necessary in the business to pay bills while waiting to be paid by customers, or the capital to be able to purchase inventory to sell later. The cost of working capital can often be very high and not as obvious of a need as capital used for equipment or furniture, but the working capital is just as real. And, this capital often reduces significantly the cash available to business owners to reinvest in the business for growth — or to harvest from the business.

Business Financing and Working Capital

Working capital is typically defined as current assets (accounts receivable and inventory) minus current liabilities (accounts payable) and is usually a positive number. This means that as the business grows, the amount of working capital required by the business also grows. This means that a growing business will often require significant investment capital in the form of debt or equity to keep working capital available. When working capital is “negative”, it means that working capital is a source of cash that can be used for growth or any other purpose (even though being called “negative” makes it sound like a bad thing) and it means that the company does not need to raise as much debt or business financing. In good cases like this, as a business grows its revenue, the customers are actually an increasing source of cash.

Time spent finding ways to optimize customer payments as a source of working capital in your business model is often a great use of time and effort, and more satisfying (and profitable) than trying to raise business financing. The accompanying graphic boxes outline five ways to finance your business with customer cash and here is a link to its article in the Harvard Business Review on this subject titled “Use Customer Cash to Finance Your Start-up”.

Related Posts:

- Financing sources can be misaligned with you

- Capital to grow: Inside or Outside?

- A Perfect Business Financing Plan

I am an investor at Greybull Stewardship, an

I am an investor at Greybull Stewardship, an

Sign Up

Sign Up RSS Feed

RSS Feed

By Venture Capital Myths -- Not the Answer for Many Companies - Mason Myers Blog December 2, 2013 - 5:09 pm

[…] so fewer entrepreneurs are forced to seek capital from VC’s. More companies are able to finance their growth from their customers. Angel investing and crowd-funding are now entering the picture as well in a bigger way, which […]

By Ideal business financing for growing, profitable companies in 100 posts or less? - Mason Myers Blog January 21, 2014 - 4:31 pm

[…] or bottom-up, and which is better for your company? Can your company utilize a structure where customers provide new capital? Can partnerships extend your skills even further? Taken all together, the structure of your […]

By Perfect Business Financing -- Maybe No Outside Equity - Mason Myers Blog March 7, 2014 - 8:46 am

[…] Best financing for a business — its customers […]

By We're In Seed-Stage Boom, Not a Series A Crunch - Mason Myers Blog April 6, 2014 - 1:41 pm

[…] raising. By far the best option in today’s world is to receive financing from your customers (here is a previous post about this). Many companies do this, and it is the optimal option available. It is usually less expensive than […]