Charlie Munger, Vice Chairman of Berkshire Hathaway, once told a friend of mine that if Charlie were a young man, he would be “trying to find online recurring revenue businesses” — like many that are being built and growing today. The combination of recurring revenue and (sometimes) defensible moats makes an attractive formula for financial returns today. Recurring revenue and defensible moats can exist today because of network effects or two-sided markets.

Munger and Warren Buffett began believing in the 1970’s and 1980’s that consumer product companies and food and beverage companies had excellent economic characteristics that would repeat year after year. This was mostly because the recurring and repeating nature of their revenue would keep the companies growing in value consistently. Occasionally, they found opportunities to invest in these type of companies at reasonable prices such as their investments in Coca-Cola, Gillette, and See’s Candies. This year, Buffett invested in Heinz which also followed the pattern.

The “recurring” nature of that revenue is good, but still not quite as good as the subscription and SaaS models that exist today, sometimes online.

Recurring Revenue Drives Consistent Financial Performance

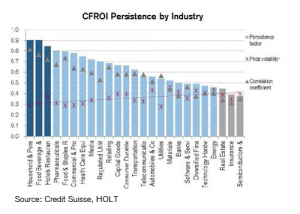

Some recent research by Credit Suisse supports this long-held view. The Credit Suisse research focused on “cash flow return on investment” and demonstrated that since 1985 consumer household and personal products led both in the most consistent performance and in the highest financial returns (13%). This was followed closely by food and beverage companies. There is a category for “software and service” on their scale, but I suspect that the scale may not include the younger companies developed in the last ten years or so.

If you are building your business and/or evolving your business model, one of the most powerful factors to build in is to build recurring revenue models if you can. It makes it much easier to grow the business rather than having to replace your old revenue each year before you can grow. It also provides to your business stability and predictability — stability and predictability that enables you to improve things over time. If revenue is there, a company can usually adjust its cost structure over time if necessary. If the revenue is faltering, that is the most difficult problem to fix.

Related Posts

I am an investor at Greybull Stewardship, an

I am an investor at Greybull Stewardship, an

Sign Up

Sign Up RSS Feed

RSS Feed

By Why Berkshire Hathaway Loves Recurring Online Businesses - May 30, 2015 - 11:42 am

[…] Article: Why Berkshire loves recurring businesses […]