My investment fund, Greybull Stewardship, has announced a growth investment in a unique platform that connects insurance companies with third-party vehicle and property photo inspections via smart phone apps.  The company, Onsource (www.onsourceonline.com), has a network of over 14,000 independent photo inspectors. I am very excited to partner with the founders of Onsource, Steve Rubin and Tim Schneider, as they have done an outstanding job growing the company. Below is the press release about the growth investment.

The company, Onsource (www.onsourceonline.com), has a network of over 14,000 independent photo inspectors. I am very excited to partner with the founders of Onsource, Steve Rubin and Tim Schneider, as they have done an outstanding job growing the company. Below is the press release about the growth investment.

OnSource receives Growth Investment Funding from Greybull Stewardship

Investment to support rapid growth and to expand existing technology-related products and services.

Braintree, MA March 15, 2015 — OnSource, the platform that connects insurance companies with third-party vehicle and property photo inspections via smart phone apps, announces a boost to its growth and expansion plans by closing a $2.25 million investment from private equity firm, Greybull Stewardship.

“Partnering with Greybull Stewardship and its founder, Mason Myers, is a real win for us,” says OnSource co-founder Steve Rubin. “Mason has a proven record of providing support, both financial and operational, that runs parallel to our motives and goals. This growth capital enables us to move ahead quickly with our expansion plans and maintain flexibility for where we take our company long-term.”

Over the past year, OnSource has developed and released a suite of self-service inspection apps along with real-time photo and video streaming technology. This growth investment will allow OnSource to broaden the development of new inspection technologies while continuing to invest in their industry leading inspection platform.

“Onsource saves insurance companies time and money through an awesomely effective platform of smart phone apps utilized by independent third parties,” said Mason Myers, General Partner of Greybull Stewardship. “We are pleased to provide the capital to support the very rapid month-over-month growth the company is experiencing.”

OnSource has experienced extensive growth in the first quarter of 2015 and is preparing to move their headquarters to larger office space in Braintree, MA to accommodate the onsite staff and support team.

“The opportunities ahead of us are exciting,” says OnSource co-founder Tim Schneider. “We’re changing the way the industry views and performs inspections and with this investment, we’re able to reach higher than ever before.”

About OnSource

Headquartered in Braintree, MA, OnSource enables companies to get fast, fair and efficient auto and property inspections through intuitive self-serve smartphone apps and an extensive national network of more than 14,000 photo inspectors. Backed by a team of quality assurance analysts and support professionals, inspections are completed quickly, accurately, and cost-effectively each and every time. To learn more, visit www.onsourceonline.com.

About Greybull Stewardship

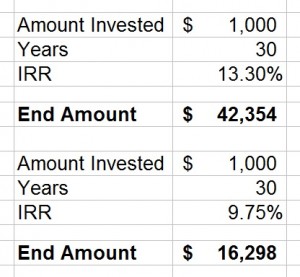

Greybull Stewardship exists to provide business owners an ideal co-owner and steward of their business and earn attractive long-term, compounding, cash-on-cash returns for investors. Greybull’s evergreen fund structure and flexible investment horizon is designed to align with the objectives of portfolio company co-owners and management, comprised of growing, profitable companies in the lower middle market with between $1 to $3 million in free cash flow. To learn more, visit www.greybullstewardship.com

###

As this is the 50th anniversary of Warren Buffett taking control of Berkshire, this letter included two extra sections. Both Buffett and Vice Chairman Charlie Munger wrote about their observations about the first fifty years of Berkshire Hathaway and what each expects in the next fifty years.

As this is the 50th anniversary of Warren Buffett taking control of Berkshire, this letter included two extra sections. Both Buffett and Vice Chairman Charlie Munger wrote about their observations about the first fifty years of Berkshire Hathaway and what each expects in the next fifty years.

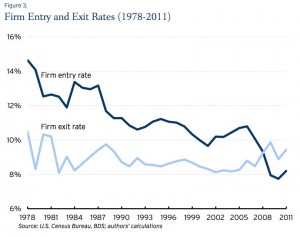

At the same time, there is data to suggest the dynamism of the American economy, including entrepreneurship, has been declining since the 1970’s. In a

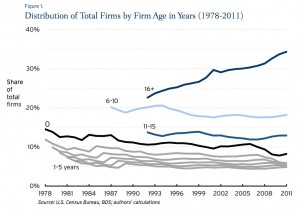

At the same time, there is data to suggest the dynamism of the American economy, including entrepreneurship, has been declining since the 1970’s. In a  Another chart from this study shows the distribution of total firms by age.

Another chart from this study shows the distribution of total firms by age.

I am an investor at Greybull Stewardship, an

I am an investor at Greybull Stewardship, an

Sign Up

Sign Up RSS Feed

RSS Feed