Defining Long Term Investing

Three years is “long-term investing” according to a discussion I attended last week. The discussion was among a handful of family office investors who help manage money for Haim Saban (participated in sale of Fox Family to Walt Disney), Eric Schmidt of Google, a wealthy Chinese family, and others. Endowments and foundations used to be long-term oriented investors and they are now feeling the short-term pressure and are being measured quarterly against their peers.

The single greatest edge an investor can have is a long-term orientation,

says Seth Klarman of the Baupost Group, a renowned value investor with an excellent track record over several decades.

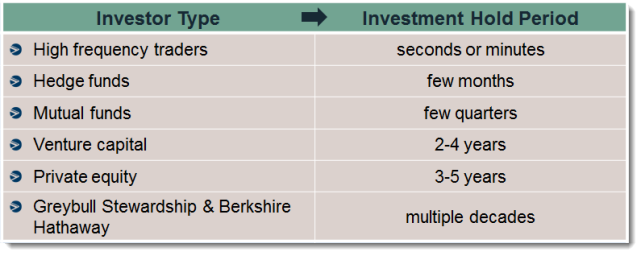

Investment Hold Period

Here is my impression of the optimal investment hold period for various types of investors:

Investing & The Long Term Advantage

In a world where investors need every advantage they can find, being able to hold an investment for the long-term is a big advantage. Nothing can be more beautiful than a good business compounding in value over a long period of time. It also helps avoid the problem of having to sell a good company and then find another company to replace it (sometimes, it is very difficult to find something as good). Some family offices for wealthy families still recognize that their ability to hold investments over the long term is one of their core strategic advantages. That also used to be the situation for the best managed endowments (Harvard and Yale), but it seems that has been shaken a bit by the extreme market pullback several years ago that left many of them in need of short-term cash. Thus, endowments and foundations are measured quarterly and have much more short-term pressure than before.

If you own a business and are looking for an investor/partner, you certainly should understand the investing time horizon for your partner to make sure you are aligned with them. I am grateful that my investment partnership, Greybull Stewardship, is set-up in a way to let us hold good investments for the long-term.

I am an investor at Greybull Stewardship, an

I am an investor at Greybull Stewardship, an

Sign Up

Sign Up RSS Feed

RSS Feed

By Competitive Advantage, Financing, Business Investment Partnership | Mason Myers Business Investment Blog January 7, 2013 - 3:17 pm

[…] Honey, I Shrunk the Definition of “Long-Term Investing” (masonmyers.com, September 26, 2012) […]

By Investment Returns, Investment Fund | Venture Capital, Business Financing | Blog For Business Owners, Investors February 25, 2013 - 1:54 pm

[…] Honey, I shrunk the definition of long-term investing [September 25, 2012 – masonmyers.com] […]

By "VC Bargain": Capital in Exchange for the 'Duty to Sell Company' - Mason Myers Blog August 18, 2013 - 11:53 am

[…] Honey, I Shrunk the Definition of “Long-Term Investing” [masonmyers.com — September 26,… […]