It is good to be the incumbent. Usually. They have often built competitive advantages over time. Except maybe in the ever-changing world of technology, it is usually an advantage for a business to have been around a long time and to have established customers, suppliers, and reputation. Also, this is true for VC fund performance as shown below. For any business owner, it pays to think proactively about how to improve the performance of your business so that it is persistently above average.

What competitive advantages can you build over time to give yourself the best odds of maintaining high performance? Or, if you are an emerging business, how can your company be 10X better than the incumbent to overcome early advantages? Both now and in the future.

It’s Good To Be a Top Third VC (for Continued VC Fund Returns)

In business, there are no extra style points for degree of difficulty, so we all might as well attempt to put in place strategies and initiatives that provide our businesses unfair competitive advantages over time. This idea jumped out at me through a study comparing the persistence of high returns by venture capital firms. It is commonly understood that the most successful venture capital firms often continue to be successful because of the self-reinforcing loop of seeing the best new companies which leads to a patina of success which leads to seeing the best new companies.

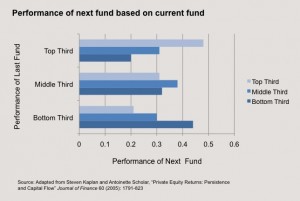

From the chart above, it is clear that a fund in the top third is more likely to have its next fund also be in the top third. The same is true for funds in the middle third and bottom third. Thank goodness my investment fund, Greybull Stewardship, is on pace to be solidly in the top third!

Competitive Advantage and Persistent Performance in Your Business

Does your business have strong persistence of performance? For all the use of the buzzwords of competitive advantage, it can be difficult and fuzzy to describe and can be even more difficult to develop over time. This post describes the attempt by Morningstar to define competitive advantages. It can also be described as a “moat” around a business as explored in this post. In thinking about it over the years, here are some observations:

- Competitive Advantage is usually built over time in small steps and decisions. Rarely is it a single flash of brilliance. It is usually built through a series of decisions and incremental steps that build the advantage.

- Focus on the differences. To be an advantage, it first needs to be different. What is different about your company versus the competition? What differences matter in your market? When trying to understand the strength of a company, it is often helpful to focus on what’s different about the company and what advantage does that difference provide, or not.

- Advantages come with trade-offs. You can’t have an advantage and be all things to all people, usually. Often, there is a clear trade-off downside to the upside of the advantage. You should be at peace with what you are giving up in order to gain your advantage. In the best circumstances, your competition is not able to make the same trade-off decision that you made for some reason, leaving you with a clear claim to the advantage that they could not replicate, even if they wanted to.

- Range from tangible to intangible. Usually, the more tangible the advantage, the better. Things like government monopolies, patent protection, etc. are usually stronger than brand advantages. On the other hand, I have come to believe that intangible competitive advantages like company culture can be very powerful and sustainable over time.

A strong moat of competitive advantage is a wonderful thing. I have found that it is best built by identifying small initiatives that both pay-off in the short-term and are a step forward in building a long-term advantage. With these, you get the double pay-off of a short-term gain and a step to a long-term advantage. And, that long-term advantage pays off repeatedly over time. Competitive advantage can be built by stacking years of decisions like these on top of each other.

Here is an entire series of blog posts about competitive advantage.

I am an investor at Greybull Stewardship, an

I am an investor at Greybull Stewardship, an

Sign Up

Sign Up RSS Feed

RSS Feed

By Myths About Timing When Raising Capital For Your Business | Venture Capital October 15, 2013 - 2:57 pm

[…] The advantage of persistently good performance […]

By Venture Capital Myths -- Not the Answer for Many Companies - Mason Myers Blog December 3, 2013 - 1:59 pm

[…] been achieved through public market investments. The top-tier firms perform consistently well (please see this post on consistently persistent performance), but many others have returns worse than zero. At a VC firm, this will put tremendous pressure […]

By Investment Returns Are Not Greener by Changing Industries - Mason Myers Blog January 27, 2014 - 12:18 pm

[…] It is easier to earn outsized investment returns in some industries over others — I agree with that conventional wisdom. As an investor or entrepreneur, it often pays off to think hard about which industries to enter. If you have a choice, why not increase your odds of success by selecting a market or industry with superior returns? We have discussed this previously with this chart of the most profitable industries and thinking about persistently high returns through competitive advantage. […]