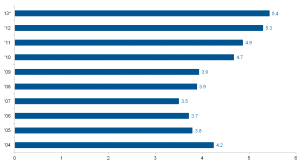

Is your business built to last or built to flip? No question influences your business strategy more than this one. There is no right answer — either strategy is fine. However, making sure that you have alignment throughout your organization on this question is very important, particularly when taking on an investor. Most private equity owners intend to only hold investments for three to five years. In fact, Pitchbook is reporting that hold periods for private equity investments have reach an all-time high of 5.4 years in 2013. This is most likely due to the difficulty in finding exits for companies bought in 2005 through 2008 which represent the bulk of the companies now owned by private equity, according to Pitchbook.

Median Hold Time (Years) for Private Equity Investments

Here are some high-level differences in strategy and structure between the two options: building your company to last or building your company to flip. My investment fund, Greybull Stewardship, is built to finance companies that are built to last. We have developed our structure and strategy to support companies that would prefer to be built to last.

Built to Last or Built to Flip?

|

Build to Last |

Build to Flip |

|

| Customers & Revenue |

Revenue always critical, but more willing to “fire” customers that are not aligned with the company |

Any and all revenue is good revenue as long as it contributes margin; little consideration of any other factors |

| Costs |

Willing to do what makes sense over a longer term time horizon |

Shorter time horizon for payback |

| Growth Rate |

Fast growth is good, but more willing to forego growth for long-term sustainability |

Faster the better |

| Employee Equity |

Will orient employee equity and profit-sharing to long-term value creation and balance near-term and long-term gains |

Will focus employee attention on an exit with tools such as stock options that really only have value upon an exit |

| Ownership |

Finding sources of long-term or permanent capital aligned with long-term value creation; Greybull Stewardship is one option |

Private Equity or Venture Capital |

| Culture |

Willing to establish more unique cultures that reinforce competitive advantages |

Only what’s needed to attract new employees |

| Employee Development |

Preference to promote from within b/c have time |

Bring in outsiders who can contribute quickly |

| Tax Structure |

More likely to earn financial returns from a combination of ongoing profits and maybe eventual exit; leads owners to select single tax of flow through entities (S Corps or LLC’s) for tax efficiency |

C Corps are the usual choice to make gains be capital gains at a lower tax rate |

| Debt |

Prudent use of debt to avoid debt-created problems |

Tempted to maximize debt and minimize equity to maximize returns |

Related Posts and Articles:

- Investment Strategy and Structure is the #1 Thing Founders and CEO’s Should Watch is Raising Capital [masonmyers.com – March 24, 2013]

- Investment Returns of Venture Capital vs. Greybull Stewardship [masonmyers.com – February 24, 2013]

- BCG Study: Superior Investment Returns From Family Businesses [masonmyers.com – February 20, 2013]

- Private Equity Exits Hit by Economic Uncertainty (pehub.com)

- Download Merrill DataSite’s Report – Pitchbook 2Q 2013 Private Equity Breakdown Report (prweb.com)

I am an investor at Greybull Stewardship, an

I am an investor at Greybull Stewardship, an

Sign Up

Sign Up RSS Feed

RSS Feed

By Business Buyers According to Warren Buffett: Competitors, Flippers, or Berkshire Hathaway! - Mason Myers Blog August 7, 2013 - 8:16 pm

[…] Built to Last or Built to Flip? [masonmyers.com – June 19th, 2013] […]

By "VC Bargain": Capital in Exchange for the 'Duty to Sell Company' - Mason Myers Blog August 18, 2013 - 11:53 am

[…] Built to Last or Built to Flip? [masonmyers.com — June 19, 2013] […]

By Business Funding | Company Culture is Affected by Source Of Capital October 14, 2013 - 3:59 pm

[…] Culture built to last or built to flip […]

By Raising Capital - Old School Myths When Raising Business Funding October 15, 2013 - 10:49 am

[…] Built to last or built to flip […]

By Path of Equity Value Creation Not Easy to Plan or Pace (see Disney) - Mason Myers Blog November 4, 2013 - 10:55 am

[…] Equity Value to Build or To Flip […]

By Path of Equity Value Creation Not Easy to Plan or Pace [Disney Diagram] | Business Value Creation November 4, 2013 - 11:05 am

[…] Equity Value to Build or To Flip […]

By Venture Capital Myths -- Not the Answer for Many Companies - Mason Myers Blog December 3, 2013 - 1:59 pm

[…] Built to Last or Built to Flip? […]

By Ideal business financing for growing, profitable companies in 100 posts or less? - Mason Myers Blog January 12, 2014 - 7:57 pm

[…] To flip or not to flip, that is the question […]

By Managing Business, Managing Time, and the Case for Doing Nothing March 11, 2014 - 9:28 am

[…] more than 20 things a business owner must balance. Should we focus inside or outside? Should we build to last or build to flip? How about Finance vs Soul? Or, work on strengths or […]