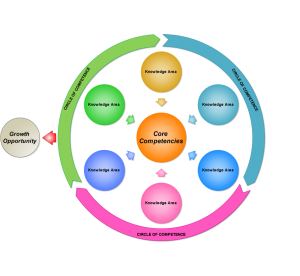

Your “Circle of Competence” is the area that you understand well. For investors and business owners, it is wise to keep your business activities within your Circle of Competence. This should not be a limiting concept — once you focus on something, you begin to see more opportunities in that area. In fact, most people have a lifetime of business opportunities staying within their Circle of Competence. One great thing about business and investing is that you can increase your Circle of Competence over time. Furthermore, everyone can be helped by spending time assessing what business activities you truly understand.

Your “Circle of Competence” is the area that you understand well. For investors and business owners, it is wise to keep your business activities within your Circle of Competence. This should not be a limiting concept — once you focus on something, you begin to see more opportunities in that area. In fact, most people have a lifetime of business opportunities staying within their Circle of Competence. One great thing about business and investing is that you can increase your Circle of Competence over time. Furthermore, everyone can be helped by spending time assessing what business activities you truly understand.

For me, the most interesting question at the 2011 Berkshire Hathaway meeting was the question, “If Warren and Charlie were young and starting out, what new area would they most want to learn and include in their Circle of Competence?” I immediately guessed that they would say health care because it is such a huge and increasing segment of the American economy and sort of fits the Berkshire preference for stable, reliable segments (reminds me of energy, or home products). As far as I know, Berkshire has not made a big investment in health care.

To my surprise, Warren responded that he would want to understand “technology” because there are such outsize investment gains to be had in technology. And then I was even more surprised when Charlie also seconded the notion with even more enthusiasm. This was particularly surprising because Warren had spent so many years saying how he “doesn’t understand technology” and this seemed to imply a disdain for something where the future cash flows could not be predicted.

I suppose I should have been able to guess that something like the investment in IBM would happen after last year’s meeting.

What is your Circle of Competence? And, what would you most like to add to your Circle of Competence?

I am an investor at Greybull Stewardship, an

I am an investor at Greybull Stewardship, an

Sign Up

Sign Up RSS Feed

RSS Feed