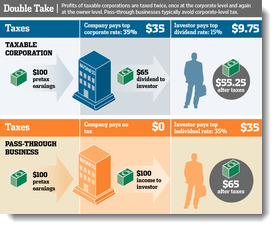

Are you still paying two-levels of tax on the income from your business? If your company is a profitable, cash-generating business, it is a large advantage to be organized as a flow-through entity for tax purposes (S Corporation or Limited Liability Company). As most of you know, this means the company does not pay income tax at the company level. Income tax is paid only by the business owners on their individual income tax returns. If your company is organized as a C Corporation, you pay tax at both the level of the company and again on any dividends.

Are you still paying two-levels of tax on the income from your business? If your company is a profitable, cash-generating business, it is a large advantage to be organized as a flow-through entity for tax purposes (S Corporation or Limited Liability Company). As most of you know, this means the company does not pay income tax at the company level. Income tax is paid only by the business owners on their individual income tax returns. If your company is organized as a C Corporation, you pay tax at both the level of the company and again on any dividends.

Unfortunately, most venture capital and private equity investment funds require their investments to be C Corporations. A rare exception is my investment partnership, Greybull Stewardship, that is structured purposely to invest in flow-through tax entities. In fact, we prefer flow-though tax entities. This is also much better for the co-owners of our portfolio companies because they can receive tax-efficient income being generated each year as well as the long-term equity value created. Many of our business co-owners prefer Greybull Stewardship for this and other reasons.

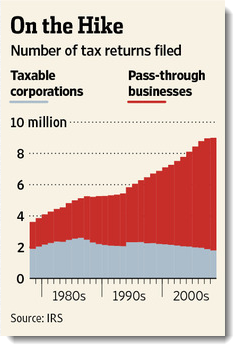

This month, the Wall Street Journal wrote a nice article about the increase in flow-through tax entities in the United States. They write that over 60% of businesses with over $1 million in profit are structured as pass-through entities. And, the WSJ writes that the percentage of U.S. corporations organized as nontaxable businesses has grown from about 24% in 1986 to about 69% as of 2008, according to the latest-available Internal Revenue Service data.

This month, the Wall Street Journal wrote a nice article about the increase in flow-through tax entities in the United States. They write that over 60% of businesses with over $1 million in profit are structured as pass-through entities. And, the WSJ writes that the percentage of U.S. corporations organized as nontaxable businesses has grown from about 24% in 1986 to about 69% as of 2008, according to the latest-available Internal Revenue Service data.

I am an investor at Greybull Stewardship, an

I am an investor at Greybull Stewardship, an

Sign Up

Sign Up RSS Feed

RSS Feed