Harvard Business School now catches up to a business trend my investment fund, Greybull Stewardship, has been focusing on for years — the increasing frequency of great businesses that have gotten to nice levels of profitability ($1-3 million) by bootstrapping (i.e., no traditional institutional venture capital). In the Wall Street Journal just before Labor Day weekend, Harvard Business School Dean Nitin Nohria wrote an Op-Ed titled “Appreciating the Big Role of Small Business.” “The most visible manifestation of Harvard’s increased focus is a class called Financial Management of Smaller Firms . . . MBA students learn in the course how to seek out, purchase and run small companies,” Nohria writes.

“The class has become so popular that we now offer three sections a year, with a wait-list clamoring to get in.”

Best Investment Class in Private Equity

To me, this asset class of smaller, fast-growing, not-traditionally-vc-backed companies is the most attractive investment in private equity or venture capital. In this category are strong, fast-growing businesses that avoid the start-up risk of an ‘all-or-nothing roll-of-the-dice venture capital’ while achieving attractive returns. The businesses are also less expensive than traditional, larger private equity acquisitions because of the inefficiencies of finding them. This is a recipe for attractive investment returns, particularly on a risk-adjusted basis. As a result, Greybull Stewardship is in the top quartile of venture capital returns according to Pitchbook — giving greater than 20% net IRR’s since inception.

My hypothesis in Greybull Stewardship is that the quantity of these business has grown larger than people expect, and grows faster now. They grow because it costs less to start-up attractive businesses (overseas programmers, Amazon Web Services), plus more information and education are available easily to these entrepreneurs, and it is easier for these firms to access and distribute to larger markets immediately. All of these efforts were much more expensive years ago, and often necessitated traditional venture capital investment for the companies to reach scale. That is no longer true.

Advantage of Greybull Stewardship for Investors and Investee Companies

For investors, there are three ways to take advantage of this attractive investment class: a) buy a business yourself, b) back a search fund (see below for links about search funds), or c) invest through an investment vehicle like Greybull Stewardship. Buying a business yourself has obvious downsides and headaches. Most importantly, one would not be well diversified which is critical in this asset class. I also think that Greybull Stewardship is much better set-up to invest in the most attractive of the companies in this asset class — much better set-up than the most obvious other option, search funds.

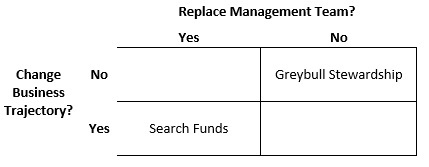

This is because search funds have three major flaws that all increase their risk: a) by definition they change the management team (risky in and of itself) and therefore only attract sellers who fundamentally are bailing out of their business for some reason, b) their goal is often to “fundamentally alter their [the companies’] trajectories” according to Nohria, which is often difficult and risky, and c) they must also time everything just perfectly to sell themselves again in a few, short years (per the search fund agreement with investors), which also increases risk.

For potential investee companies, Greybull is a much better choice for the best of the companies with a management team who wants to stay at the company, who has a lot of equity and who wants to keep a significant amount, and who doesn’t want to be forced to exit the company in the future on a time frame that may or may not be best for the business or for minority owners.

As the investment world continues to expand, I think this trend is healthy for investors identifying newer categories and sub-categories of venture capital and private equity. It is a natural evolution.

Related Links:

- Why More MBAs Should Buy Small Businesses – Harvard Business Review

- Buying a Business: Raise Money for the Search or Not? – Mason Myers Blog

- Disparate Data Points: Entrepreneurship Exploding or Dying? – Mason Myers Blog

I am an investor at Greybull Stewardship, an

I am an investor at Greybull Stewardship, an

Sign Up

Sign Up RSS Feed

RSS Feed