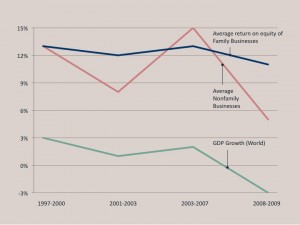

Deep wisdom exists in how family businesses are managed for the long-term. In fact, the financial returns for closely held businesses outperform their peer groups across business cycles according to a recent study by the Boston Consulting Group and Sophie Mignon of Ecole Polytechnique. While their returns may be lower in good economic times than their peers, returns are better in slower economic times and across business cycles.

To me, it is obvious how investment time horizons influence how any asset is managed. If you own a car for one year, you manage it very differently than a car you plan to own for twenty years. It is obvious that a short-term ownership cycle of a few years may generate good returns for those years, but this is also very likely to leave the company in a less than ideal position for the long-term. A longer term time horizon seems to put the company in the best position to earn optimal returns overall.

Wise Management from Family Business

This article in the Harvard Business Review explains some differences about how closely held businesses are managed.

- They are frugal in good times and bad.

- They keep the bar high for capital expenditures.

- They carry little debt.

- They acquire fewer (and smaller) companies.

- Many show a surprising level of diversification.

- They are more international.

- They retain talent better than their competitors do.

My investment firm, Greybull Stewardship, is organized to be an ideal home for closely held businesses who want to sell the business or receive investment but not change the long-term orientation and culture of the business. I am motivated to earn optimal returns over the long-term by allowing these businesses to pursue the unique strategies that made them successful in the first place.

Related Posts and Links:

I am an investor at Greybull Stewardship, an

I am an investor at Greybull Stewardship, an

Sign Up

Sign Up RSS Feed

RSS Feed

By Investment Strategy & Structure Is the #1 Thing Founders and CEO's Should Watch In Raising Capital - Mason Myers Blog March 24, 2013 - 8:29 am

[…] BCG Study: Superior Returns from Family Business — [February 20, 2013, masonmyers.com] […]

By Unique Businesses Are A Force For Good - Mason Myers Blog April 4, 2013 - 9:48 am

[…] BCG Study: Superior Investment Returns From Family Business — [February 20, 2013, masonmyers.c… […]

By Business Buyers, Types of Buyers | Warren Buffett, Berkshire Hathaway | Business Blog For Owners August 9, 2013 - 10:33 am

[…] BCG Study: Superior Investment Returns From Family Business [masonmyers – February 20th, 2013] […]

By Company Culture Like Fine Wine or Great Coffee - Mason Myers Blog October 13, 2013 - 1:51 pm

[…] Superior culture in family businesses […]

By Raising Capital: About Fit and Timing - Mason Myers Blog October 20, 2013 - 4:32 pm

[…] Family culture raises its capital […]