In business decision making, we never have as much information or certainty as we would like. The best business and investment minds know how to focus on the factors in a decision that are the most relevant and ignore extraneous factors. It is a real skill — one that can be learned over time and can be improved.

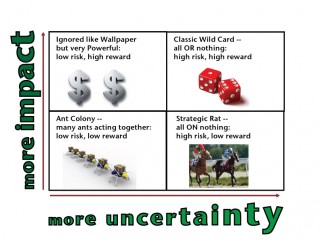

A tool to help in these circumstances is a tool developed by Harvard Business School professor Howard Stevenson and Eileen Shapiro in their book, “Make Your Own Luck.” They call it a Gambler’s Prediction Map. They use it to list and organize the potential factors that could have a major impact upon the objective you are trying to achieve with your decision. Once you list the factors, then you organize them in the classic b-school 2X2 matrix with the impact on the vertical axis (low and hi) and the uncertainty on the horizontal axis (low and hi) as shown here.

Their gambler’s prediction map has four zones: (1) in the “wallpaper zone,” “factors are often ignored, but can be very powerful.” For business owners and investors, this zone may be the most important. (2) Their “wild card zone” has “unpredictable factors that can work massively in your favor — or against it.” The high drama here is often best left to the movies. (3) Their “ant colony zone” is where, like ants, “many of these factors put together can create substantial advantages.” (4) Their “strategic rat hole” is a “place you’d rather not be.”

Focus on Factors with More Certainty to Help with Decision Making

The advice of Stevenson and Shapiro is to focus on the left-hand side of the matrix — the low uncertainty side. Because these factors are more likely to impact your objectives, time spent understanding these factors can be more productive. Regarding the right side (high uncertainty), “the job of the smart gambler is to lessen this uncertainty risk — sidestep it, avoid it, lessen it, or hedge it. The one thing you shouldn’t do is accept high risk with the same payoffs you could get with a less risky bet.”

Their book breaks the common cliche: “We believe that smart bettors reject the notion that higher returns always entail higher risk.” For that reason, they’ve structured their maps specifically to highlight opportunities for breaking this cliche to your advantage.

I believe this same matrix could be used to organize a list of potential growth initiatives, or R&D projects, or other problems that need to be prioritized in a business. A good decision-maker will focus upon the “wallpaper zone” of high impact and low uncertainty projects, Such projects move the organization “to get more of what will help us — with less uncertainty about the outcomes we will achieve.” For more, see the book written by Stevenson and Shapiro.

I have written about other frameworks and mental models that can be helpful for business owners in these posts below.

- Investment Wisdom Convergence from Clayton Christensen and Charlie Munger [masonmyers.com May 20, 2013]

- BCG Growth Share Matrix Cash Cows, Dogs and Stars [masonmyers.com July 7, 2013]

- Five Forces by Michael Porter — Fundamentals Through Graphics [masonmyers.com February 3, 2013]

- Economies of Scale — Fundamentals Through Graphics [masonmyers.com Oct xx, 2012]

I am an investor at Greybull Stewardship, an

I am an investor at Greybull Stewardship, an

Sign Up

Sign Up RSS Feed

RSS Feed